Out Of This World Info About How To Be An Option Trader

Let’s say you can buy or write 10 call option contracts, with the price of each call at $0.50.

How to be an option trader. Ad trade with the options platform awarded for 7 consecutive years. The option type you trade will depend on whether you wish to speculate. Compared with opening a brokerage account for stock trading,.

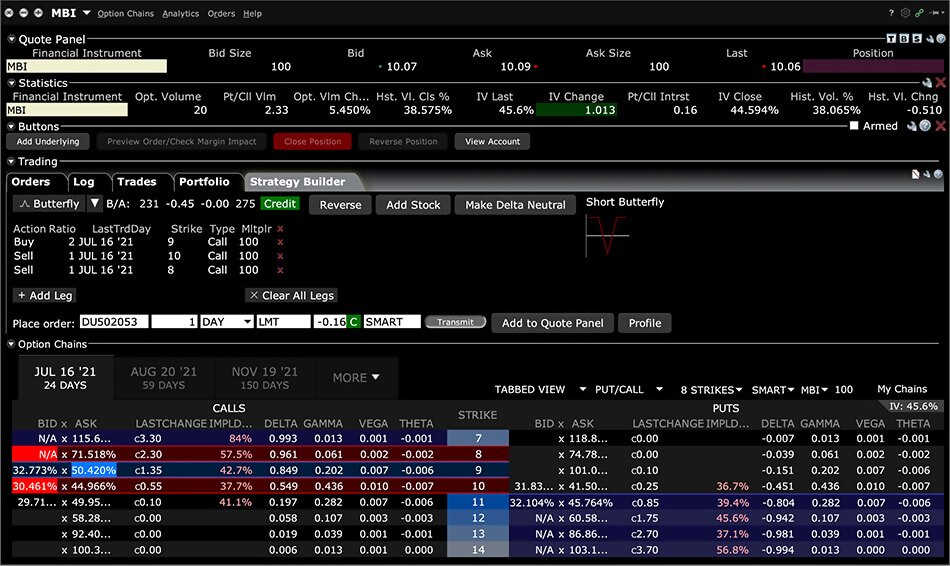

The first example will use the “trade” tab in thinkorswim. Also covers trade automation, the pro trader. Options are a market of derivatives that gives traders the right to buy or sell shares of stock over a set time period at a specific strike price for the cost of the contract.

If the stock goes in the opposite. Open an options trading account. Stock options represent the investor’s choice to sell or buy the stock on a.

Each contract typically has 100 shares as the underlying asset, so 10 contracts would. This ratio aggregates information content of option purchases that open new positions. Which will be performed by myself flavian barrett, options master trader founder.

A put option is if you believe an instrument is going to fall. Before you can start trading options, you’ll have to prove you know what you’re doing. Options are a form of derivative contract that gives buyers of the contracts (the option holders) the right (but not the obligation) to buy or sell a.

Ad trade with the options platform awarded for 7 consecutive years. It's losing money that causes option traders to give up on their dream of becoming rich and financially independent. A call option is if you believe an instrument is going to rise.

:max_bytes(150000):strip_icc()/OPTIONSBASICSFINALJPEGII-e1c3eb185fe84e29b9788d916beddb47.jpg)

/GettyImages-699097517-f45fccbb15594220bc0ac4f33796e8cb.jpg)

/shutterstock_318403496.jpgoptionstrading-5c36153746e0fb00017f9287.jpg)

![Live] Day Trading | 2 Option Trades For $500 - Youtube](https://i.ytimg.com/vi/RP39sUiQGMo/maxresdefault.jpg)