Out Of This World Info About How To Get Rid Of Unsecured Debt

Many americans are in need of reliable debt reduction tips, in order to get rid of their unsecured debt.

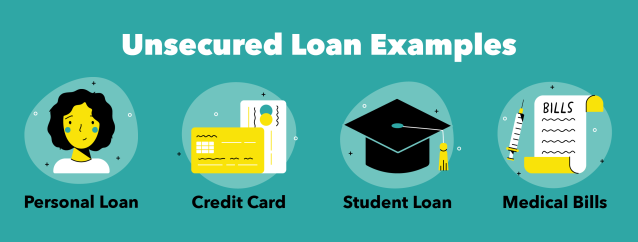

How to get rid of unsecured debt. How to get rid of unsecured debt to eliminate unsecured debt, you essentially have two options: Pay it off or file for bankruptcy. Ad our certified debt counselors understand options and know what to do.

Our goal is to help you make smarter financial decisions by providing you with. Most of them are involved in these major debt problems due to the unbalanced financial. Geller is a certified specialist in consumer bankruptcy law by the american board of certification *.

In these trying economic times, we have seen many hardworking americans lose their homes and have their vehicles repossessed. If you can get more than you owe for the asset, you can use the money from the sale to get rid of the debt. Eliminating unsecured debts with bankruptcy eliminating unsecured debt is one of the primary benefits individuals receive from a bankruptcy filing.

If you’re looking to get rid of unsecured debt. Debtors decide to get rid of unsecured debt generally simply because it would assist them lower their money owed considerably and they would opt for this choice than going bankruptcy which. It may also lower your interest rate.

Once you meet all legal. Maximum of you are highly indebted in order to maintain your minimum living. If so, you can and should consider your debt relief options.

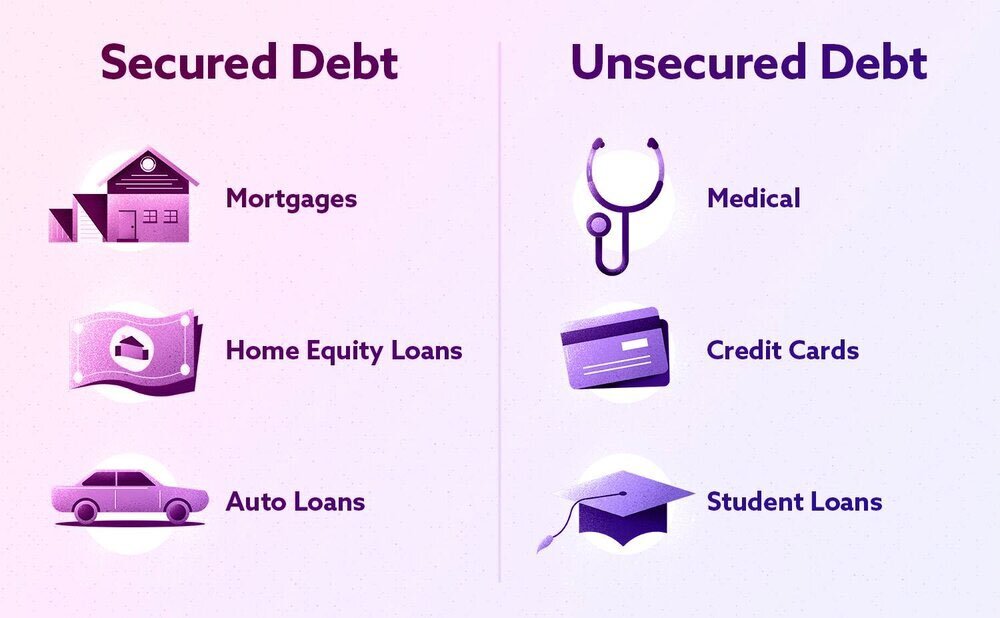

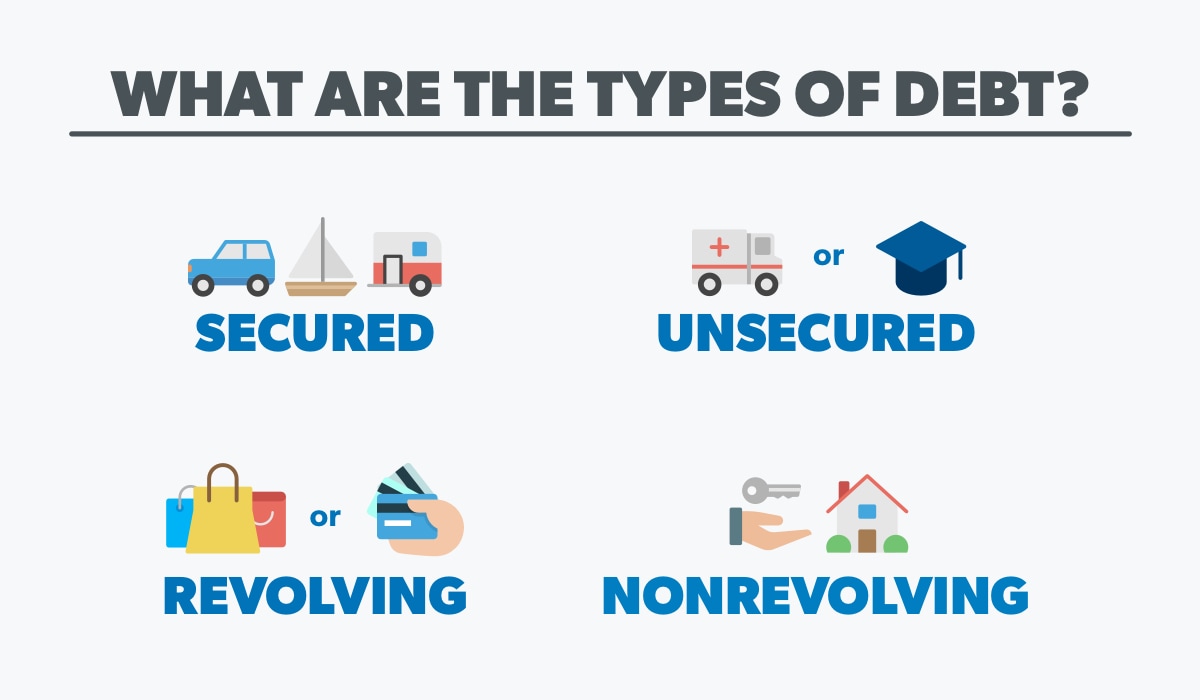

How is unsecured debt treated in chapter 13 bankruptcy? To understand the differences between secured debt and unsecured debt, i would like all you readers out there to sit up and take note if any of your property would be taken away from you. To get rid of unsecured debt with creditors who do not allow snowflake payments or that charge a fee to process these payments, consider consolidating these debts with a different lender.

:max_bytes(150000):strip_icc()/whats-difference-between-secured-line-credit-and-unsecured-line-credit-v1-b78ddb9683b24ef2bc31743c5b3b13d2.png)

/GettyImages-1093086154-058134c8013c4dba80e8fbd13289c7ab.jpg)